This Week in Tech Episode 902 Transcript

Please be advised this transcript is AI-generated and may not be word for word.

Time codes refer to the approximate times in the ad-supported version of the show.

Leo Laporte (00:00:00):

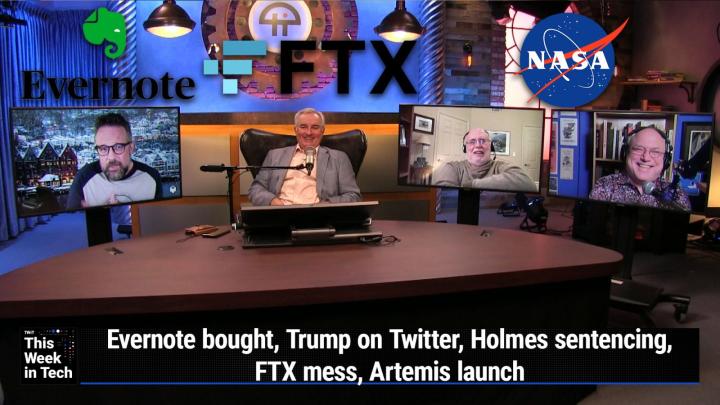

It's time for Dwight this week in Tech. We have a great panel for you. Glen Fleishman is here. Uh, Dwight Silverman, formerly of the Chronicle, and a CEO who knows a lot, Mr. Phil Libin, one of the founders of Evernote and the creator of mm-hmm. <affirmative> the app with the crazy name. We'll talk about what's going on at TWiTtter. Phil has some, some calming words for us. Elizabeth Holmes gets 11 years in federal prison. Is that too much? And we now know the Earth weighs six monograms. What's a monogram? Stay tuned and find out. TWiT is next. Podcasts you

TWiT Intro (00:00:41):

Love from people you trust. This

Leo Laporte (00:00:45):

Is is TWiT.

(00:00:51):

This is TWiT This week in tech. Episode 902 recorded Sunday, November 20th, 2022 may contain nuts This week. Tech is brought to you by Zip Recruiter. ZipRecruiter makes it easy to hire for even the most specific role. Like, well, I don't know, mascot in Missouri. In fact, four out five employers find a quality candidate within the first day. Try it free today at ziprecruiter.com/TWiT. Zip Recruiter, the smartest way to hire and by Neva. Neva has simplified everything about meetings and classroom audio. You get great audio and systems that are easy to install and manage. Visit neva.com/TWiT and get 50% off one Neva HDL 300 system for mid-sized rooms when you get a live online demo and buy before December 16th, 2022. And buy Wealthfront. Visit wealthfront.com/TWiT to get started and get your free $50 bonus with an initial deposit of $500. That's wealthfront.com/TWiT And buy express vpn. Protect yourself with the VPN that I use and trust. Use express vpn.com/TWiT today and you'll get an extra three months free on a one year package.

(00:02:16):

It's time for TWiT this week in Tech, the show. We cover the week's tech news and as Phil said, there's not much to talk about this week. Phil Liban is here. It's great to have him. Love Phil first became aware of him when he was founder and CEO of one of my all time favorite note taking apps. Evernote. He is, uh, since moved on, he is now, uh, the co-founder and CEO of All Turtles, which is what an AI kind of, uh, proving ground, uh, and mm-hmm. <affirmative> the app with the name mm-hmm. <affirmative> MM. H M M that he's using right now to be flying in his private jet. Hi, Phil. Hey, Leo. Nice to meet you. It's great to have, have you, uh, on the show. Always. Uh, welcome. Uh, I brought you on this week because of course Evernote is in the news, and we'll talk about that in just a little bit. I'd like to get your take, but you're, but then there's many other things I wanna talk to you about. Of course, you've run companies, you know what it's like to take over a company, um, to have technical infrastructure, have technical debt. I want know what you think of what's going on at TWiTtter. And because you were born in the Soviet Union and I have Ukrainian family, I'd love to hear your thoughts about all of that. So we have lots to talk. All

Dwight Silverman (00:03:29):

The fun topics. Alright.

Leo Laporte (00:03:30):

Yeah. Sorry, I'll throw some, we'll do something silly. We'll throw something silly. <laugh>. That's Glen Fleishman. He's in charge of fun here, uh, at the network. We love seeing Glen. glen.fun is his website. You see him on Mac Break Weekly. You see him on our Mastodon, where he is a great contributor. Hi, Glen.

Glen Fleishman (00:03:47):

Hello. Thanks, Rodney, back for this boring, boring week this week in which nothing whatsoever happened. Nothing anywhere in technology.

Leo Laporte (00:03:55):

Nothing, nothing, nothing.

Glen Fleishman (00:03:57):

We'll find something to

Leo Laporte (00:03:58):

Talk about. So slow and a dear friend who's been with us for many, many years. I remember talking to you when the iPad came out. How many years ago is that? Dwight Silverman? Uh, many years at the Houston Chronicle. He ran a radio show and outta Texas for a long time. He's at all three.com/d Silverman. That's where all of his, uh, work goes. And there's quite a bit of it. Good to see you, Dwight,

Dwight Silverman (00:04:21):

And it's really good to be here. Yeah, I'm looking forward to talking this week because, you know, as Phil said, it's a slow news week and we got a chance to make stuff up this week, and I'm all about

Leo Laporte (00:04:32):

That. Uh, wow. I don't even know where to start. We should have had a vote. Uh, <laugh>. I mean, holy cow. Holy cow. Um, yeah, let's do a TWiTtter poll. So let's, you said the word TWiTtter, might as well do it. Uh, Donald Trump is back, uh, on the, on the Blue Bird. Not that he said anything. In fact, in a way, I don't know if he should be too glad he's back because the tweets are the last tweets he made on January 6th. Uh, somewhat incriminating, maybe. Uh, he has said that he's gonna stay on his own, uh, site truth social. But this is the latest thing, uh, that Elon, uh, did that is kind of contradictory to something he said earlier. He said, we're gonna have a, a panel of experts to approve the re return and departure of people. And then, eh, forget that. Let's have a poll.

(00:05:26):

As many have pointed out, uh, that poll is easily gamed. Uh, somebody said, well, now we know what the G u wants. Although, I gotta say it was pr it was surprisingly close. I thought it would be overwhelmingly in favor of bringing back the former president. Um, so it, so much has happened. TWiTtter is the gift that keeps on giving. Although I saw Mike Maples Junior, uh, kind of snappish. Maybe you saw this too, Phil, on TWiTtter saying, uh, to, uh, one of the, I think it was to Casey Newton, a platformer who's been covering this, doing a very good job. He's got a lot of sources in TWiTtter saying, why don't you cover something more productive than the the demise of TWiTtter? I think this is a bigger story. This is not, this is a real news story, isn't it? Or is it just a soap opera, Phil?

Phil Libin (00:06:13):

I mean, it's both. Uh, I, I, I am not expecting the demise of TWiTtter out of this. There's, uh, you know, more drama than is probably, uh, strictly necessary. Uh, but yeah, it's been, it's been interesting to watch. It's definitely maximizing for my entertainment.

Leo Laporte (00:06:29):

Uh, it is entertaining. Uh, it was very sad on TWiTtter on Friday night, uh, when the news came that, uh, you know, this was Elon's deadline, uh, for engineers to either go hardcore or go home. And, uh, he put out a, a form, a Google form of odd, oddly enough, uh, that somebody should check saying, yes, I'm willing to go hardcore with you, or, no, I'll take my three month severance. Now, uh, I imagine a number of, we don't know what the actual response, well, the New York Times, uh, is reporting at Casey is reporting about 1100 engineers took advantage of that three month, uh, severance. I think that's the sensible thing to do, but I, it's not binding. I imagine a, a large number of people just said, I don't have to answer that <laugh>. I'm gonna close the work.

Glen Fleishman (00:07:14):

Is anybody left there who could fire them? That's the question I was reading. I think it, New York Times had a, one of the anecdotes they had was a woman roaming around the building for two days because her manager had been fired to try to give notice. And she finally found her new manager gave notice, and then that manager was fired the next day or left. So it does have a kind of a keystone cop smarts, brothers, uh, Fellini vibe. Like, there's just a, a lot of stuff happening all at once. And some of it's fart and some of it's, um, you know, overwhelming.

Leo Laporte (00:07:43):

And some of it's rumor that is probably not provably true. For instance, there, there was a confirmed story that badge access was turned off, uh, on Friday, and nobody could go in. Nobody was gonna be able to go in until Monday. But Elon at one 20, uh, on Saturday morning, posted a picture of him going Beast mode with the remaining engineers. It's a small group, and, uh, there's only one, two, a few women, mostly guys. Um, this is what's left, uh, Elon inside, this is his so-called code review. Uh, he was telling bring, bring, uh, bring 10 screenshots of your code. This is what he posted on his TWiTtter. It doesn't look like code. It looks like they're telling him how TWiTtter works at this point. Yeah. Um,

Glen Fleishman (00:08:34):

Also, I wonder what he disabled card key access, was he trying to keep people in or keep them out? I wasn't

Dwight Silverman (00:08:38):

Sure. Supposedly the rumor was that the card key access ended because the whole team that managed it was gone. <laugh>,

Leo Laporte (00:08:47):

That was a bad, that was a tweet from a prankster, by the way.

Dwight Silverman (00:08:50):

Yes. Right,

Leo Laporte (00:08:51):

Right, right. And the prankster said, nobody can get out. So they had to call me back in. But of course, course card keys don't work that way. They keep it out, not keep people in. You'd have a fire code violation if you couldn't get out

Dwight Silverman (00:09:00):

The, the, the, the deadline was Thursday. Yeah. And, and one of the thing, and supposedly the form that you went to when you clicked on his link was simply Yes,

Leo Laporte (00:09:13):

<laugh>. Oh, I didn't do that. Oh,

Dwight Silverman (00:09:15):

Interesting. Yes. And the people and the people who didn't click yes. Were presumed

Leo Laporte (00:09:19):

To have by default,

Dwight Silverman (00:09:20):

That's no resignation. Right,

Leo Laporte (00:09:22):

Right. So, and

Dwight Silverman (00:09:23):

That's how it worked.

Leo Laporte (00:09:25):

Uh, you've run technical teams, Phil.

Phil Libin (00:09:28):

Yeah. Still am.

Leo Laporte (00:09:31):

Um, how do engineers take to this kind of thing?

Phil Libin (00:09:36):

Look, I think, um, Elon's always been an outlier. Uh, and TWiTtter's an outlier, and there's not that much that we can learn from really studying, you know, outliers. Like, by definition, most things don't behave like this. Most companies don't run like this. Uh, I think it's hard to predict, uh, how it's gonna go other than look at the end of the day, like it's a website, they're gonna figure it out. This isn't the hardest thing that, that the Elon's like built. Uh, I'm pretty sure they're gonna get it right. Again, there's gonna be a lot more drama than, than, you know, than I would've liked to see. And a lot of people's lives get, uh, kinda turned upside down, or at least add a lot of uncertainty around who gets, you know, who around jobs. Uh, so it's like, it's drama, it's theater. But I think people like predicting that this is the end of TWiTtter. I, I don't know. I mean, maybe right. Hard to know the future, but I'm, I'm certainly not expecting it to, to,

Leo Laporte (00:10:27):

I don't think, you know, a lot of people said, oh, it's only a matter of time for the website fails. I don't, first of all, you design it to keep going. Uh, even if everybody walked out the building, it would keep going for some time. Um, I don't, yeah, you're right. I don't see this as the end of TWiTtter. Maybe the bigger question is the end of content moderation. I, for a while, people were posting full lengths Hollywood movies on TWiTtter. They fixed that, by the way. They, they, the, the crew that was taking that stuff down and came either arrived or finally noticed.

Glen Fleishman (00:10:59):

Yeah, I, I gotta strongly disagree on the technical side, not because I have magic insight into TWiTtter's code base, but every report that's come out of there from people who've left recently and many people in the past, is that they have, uh, an incredibly fragile info infrastructure that they've barely been able to keep alive for years. And that there's so much, uh, accumulated technical debt without working on core restructuring, refactoring all the rest of it to keep it more reliable. Um, you know, mud, who was the engineer who left, became a whistleblower, he said that thing about, which makes a lot of sense, is that there's so many, so many services that depended each other. If there were actually a complete temporary collapse of the systems, everything had to be shut down, you know, basically power cycle, everything, then they might not be able to bring it back up because some services are dependent and other things running.

(00:11:50):

And if those aren't running, they can't come up. So, I, I don't wanna predict, uh, doom, but when you get 75 or 80% of the people at a company are gone, they're running their own data center operations for the most part, which is unusual for a company of, of that particular scale. And with those kind of operations, there's so much that could easily go wrong, and the person who knows how to fix it is nowhere in sight. So I don't think it's necessary that the site just goes down as, you know, entropy and that they can't fix things. But that there may simply be too many plates spinning that all crash the ground at once and they can't catch them.

Phil Libin (00:12:26):

There may be, or, or it may be okay. <laugh>.

Glen Fleishman (00:12:29):

Well, I mean, I think it's, but it's when you, if you had, if you fired, if you fired 80% of your staff, could you keep everything running on an operation that, that serves hundreds of millions of people and is got all of these conflicting regulatory and, uh, other, I mean, they've got regulatory burdens to meet, they have technical burdens to meet. They run their own infrastructure.

Leo Laporte (00:12:50):

I guess that's a good question is which is gonna be the first to go? Is it gonna be <laugh> the, uh, content layer or the technical layer? Um, the content's gonna be tough. You've got, as you said, uh, and I think Elon under estimated how many different countries he was gonna have to appease, many of which he does business in with Tesla. Uh, that's gonna be a real challenge, uh, for him. Um, he also seems to have a failing common amongst some billionaires that he, he seems to be very hands on. And I, I little bit worry that, you know, when he says, we're gonna turn off 80% on microservices, that's

Glen Fleishman (00:13:32):

It. Yeah.

Leo Laporte (00:13:34):

Uh, that there's no one there to say, you know, Elon, that's a bad idea. And here's why. UL Roth for a long time, uh, Jeff Jarvis was saying, well, it's not gonna be too bad because UL Roth is there head of trust and safety. He's not mm-hmm. <affirmative>, in fact, wrote a piece, uh, on the New York Times. He was very judicious, I think. Yeah.

(00:13:54):

But he said they don't need a head of trust in safety because Elon is making the decisions now. In other words, it's not a, it's not a, it's, it's not a, it's not a democracy. It's not, he doesn't have advisors. It's Elon. And he says, well, you don't need me anymore because, uh, I got nothing. I got nothing to say about anything. And they may be, and I know probably this was another story, was that some engineers were worried about long term liability if they stuck around and had no power to, to, to counter Elon's worst impulses.

Phil Libin (00:14:30):

But, okay, so look, um, I don't remember a previous time where so many people have like actively and gleefully wanted a company to

Leo Laporte (00:14:42):

That's a good point. And there is a very much

Phil Libin (00:14:44):

And so publicly. Yeah.

(00:14:46):

Um, and, and, and even, and, and many of the people who wanted to fall apart also wanted to stay and not fall apart. You can have both of those ideas in your head at the same time. Uh, you know, TWiTtter, TWiTtter in the long term has been one of the companies, uh, that's really, um, I think forced our society and our discourse to become max to become all about like exaggerating conflict. Like TWiTtter has helped make, has has helped like professional wrestling, eyes <laugh> in most of our conversations. I don't think they've been as guilty of this as Facebook. I think Facebook has been worse. Um, but, but TWiTtter certainly contributed to that. And, you know, a few years ago, Jack decided, Hey, this is, this is bad. And so they're gonna focus on healthy conversations, and they tried to figure out our tone down, and they were, you know, successful to some extent. But it's, it's, it's appropriate. Like TWiTtter, the company that made everything into high drama is now experiencing

Leo Laporte (00:15:40):

<laugh>. What a surprise. Um,

Phil Libin (00:15:43):

But

Leo Laporte (00:15:43):

It's hard.

Phil Libin (00:15:44):

Well, yeah. But, but this isn't, like, this isn't ironic. It's the opposite. It's, it's exactly what you would expect. It's inevitable Yeah. To happen. Wouldn't inevit inevitable? She's expect's expect to happen. It's inevitable. That's funny. But it doesn't mean that like, it doesn't like, yeah. It's gonna go through a period of high drama. I think, again, it's hard to predict the future. Uh, I have seen a lot of the stuff that Elon's done. I think we all have, I have some sense of the complexity required to run systems that hundreds of millions of people use. I've never, I've never operated systems that more than hundreds of millions of people use. But I have operated systems that hundreds of billions of people use, which is not quite the scale of TWiTtter. But also that was for me many years ago. Things have gotten a little bit easier with infrastructure. So I have some appreciation of that. And I've seen other stuff that Elon's done, and in, they're like, orders of magnitude harder than, than SpaceX

Leo Laporte (00:16:28):

Is harder. What he's done with Tesla is harder.

Phil Libin (00:16:30):

The boring company is harder. The

Leo Laporte (00:16:32):

Boring company

Phil Libin (00:16:32):

Company. Yeah. Like, look, I would've preferred that he buy TWiTtter and, you know, rename it to the other boring company,

Leo Laporte (00:16:38):

<laugh>.

Phil Libin (00:16:39):

He could calm and calm and he decided to go in a different direction. That's Elani. He's much more

Glen Fleishman (00:16:44):

Complex. Bill, I wanna make sure I didn't, I didn't actually insults you earlier because I realized what you're just saying. If you built a company and you laid off 80% of people that worked for you, if that inevitability had to happen for business reasons or whatever, I believe your company might actually still run. I also believe Tesla was built. You know, Elon came in a little bit into it. He built the company is today, he made a lot of dec he made nearly every decision. Right. Same thing with, uh, SpaceX. This is not a company, you know, he may not have invented the fundamental technology involved. He's not a space engineer. He made a lot of decisions and it's, he's responsible for, for good or bad or everything that's come out of that and their ability to perform today. Yeah. He did not build TWiTtter and he went into TWiTtter as if he had built it. And thus, intuitively knew everything that went on. And I, I think you, I'd like to picture you going into TWiTtter, having spent 45 billion, I'm sure you've got the lying around and have, uh, have bought it and gone in there. And how you would've approached it, I cannot imagine would be, uh, be like him, uh, at all. Because you didn't build it, you didn't build that

Phil Libin (00:17:43):

Technology. Yeah. Look, obviously, like, so first of all, I, I, I don't think I would lay off 80% of, of, of, of, of my staff. I don't know that Elon has either. We're not sure what that,

Glen Fleishman (00:17:51):

That's, we don't, we don't have any idea. Right. We know it's 50 to 80%.

Phil Libin (00:17:54):

Yeah. Uh, but, but if you, if you phrase it a different way, if, you know, if I was running something like TWiTtter at 80% of my staff became, you know, incapacitated mm-hmm.

Leo Laporte (00:18:03):

<affirmative>

Phil Libin (00:18:04):

C 23 or something, uh, would I be able to keep it running? Yeah. Yeah. I would

Glen Fleishman (00:18:08):

Be. Yeah. I believe it. If you, if you built it. I believe it.

Phil Libin (00:18:10):

Well,

Glen Fleishman (00:18:12):

I mean, I, I don't think everything's iuc or is non, or is, uh, reducible inex enough that I think, I think looking at TWiTtter from the outside, it feels very fragile. And looking at what, and watching Musk tear wires out, it makes it feel very fragile. So if it's more resilient than it appears, that's great. And I don't want to dance on TWiTtter's grave cuz it's responsible for a lot of professional success and friendships and so forth. Yeah. But I also don't want it to, I think it's climbed out of a deep hole and I don't want it to fall back into it, which is what it seems like he's leaping broadly into, without a bungee chord.

Phil Libin (00:18:46):

I'd say two quick things kind of structurally about this. First of all, large, you know, in some part, thanks to TWiTtter, not entirely, but in some part, thanks to TWiTtter, most things are worse, seem worse than they really are

Leo Laporte (00:18:58):

<laugh>. Right?

Phil Libin (00:19:00):

Like, most things in, in in life seem worse than they really are because engagement based business models, ad based, you know, micro clicking business models incentivize everything to seem worse than it really is. And TWiTtter, old TWiTtter bears some of the responsibility for that. I don't think, not as much as, you know, not as much as meta or Facebook, but some, um, and I think actually one of the things that Elon is doing, trying to reduce the, the, the, the reliance and advertising is, it's like a very good thing because like, it really can like dial the temperature down because otherwise the incentive is to make everything seem worse than it really is. So that's kind of the first thing. And again, TWiTtter is now at the eye of, of the TWiTtter storm. It's like all of the inflated drama is now being focused on itself. So of course it seems terrible. That's exactly what you mean. It's not saying it's not bad, but it's probably, it's probably not as bad as it seems. It probably looks worse than it really is. And the second thing is like, um, I don't think that Elon, I, I, I don't know him very well personally, uh, but I I I I very much don't get the sense that he's a person that surrounds himself with Yes. Men. Really. People that see this is

Leo Laporte (00:20:04):

Very, that's interest. Wow. Okay. That's good news. That's a good thing. Somebody besides Jason call Canis and David sex advising him. Yeah.

Glen Fleishman (00:20:13):

His, his text messages would not support your statement

Phil Libin (00:20:16):

Because he's in professional wrestling mode.

Leo Laporte (00:20:18):

<laugh>

Glen Fleishman (00:20:19):

No, I mean, his private text

Leo Laporte (00:20:20):

Messages. So he's doing a Hu Kogan at this point. Yeah. Support

Glen Fleishman (00:20:23):

Privately and publicly makes the same kinds

Phil Libin (00:20:25):

Of statements. I know, I know, I know. You know, several people that, that, that, that are relatively close to him and other companies. I know what he's built. You don't, you don't build you don't return rocket boosters synchronized. That's

Leo Laporte (00:20:36):

Pretty impressive back to

Phil Libin (00:20:37):

Earth. I agree. Being surrounded by yes men, you just don't, but that's the conundrum. That is not a thing that happens. Yeah.

Leo Laporte (00:20:42):

It's the conundrum about Elon is there is this amazing track record and I, I really loved the manifesto he wrote for Tesla way back in the day. And yeah. And, and it's very impressive. But then there's this other guy, the guy we see on TWiTtter, uh, and it's a, it's like a different person. It's like a guy who's used too much acid and is confused and seems to believe his own story. And it's, it is possible. Isn't it, Phil, that, that he's changed a little bit since

Phil Libin (00:21:11):

It, it's possible. I don't, I wouldn't know. It's possible. Yeah. I don't know. It's obviously possible, but it's also possible that it's gonna be fine.

Leo Laporte (00:21:16):

Yeah, I would, I want it to be fine. Cause I'll tell you one thing, and I think everybody agrees. TWiTtter's important. Yeah. And, and it would be a horrific outcome if somebody buys it and drives it into the ground. There's been some speculation. Wesley Faulkner sent me a tweet, or I'm sorry, I toot saying, uh, he thinks that Elon was forced to buy it. Uh, he knew the court was gonna go against him. He was gonna buy it. And what he's trying to do is get out of his debt by forcing a bankruptcy and a reorganization so he doesn't have to pay back the debt. He's got a very large nut to cover a 1.3 billion interest payment alone every year. So that's, that's a completely outta nowhere theory. I don't know about finance and the way you do, obviously, but is it possible that that's what's going on? That Elon just wants to get out of this and this was the only way he thought he could do it?

Phil Libin (00:22:08):

What's, what's the outcomes? Razor explanation.

Leo Laporte (00:22:11):

God, I don't think that, you know, that's this. I wish there were one. The simplest, the simplest solution is always the right one. But I don't know what the simple solution is. Here's, here's the scenario that sounds like the OMS razor to me. Elon in a j almost and maybe in a fit of peak said I wanna buy it. And then for 54 20, the very fact that it was 54 20 is the price to me implies jest. You know, the four 20 in there is marijuana reference. Uh, that then somehow, this is the question mark, how do he get in this? He made an agreement with TWiTtter that he would buy it without due diligence, which no intelligent business person would ever, ever do. So I don't know what happened there. Remember he bought 9% of it and, and then in January and then in April, went public with that, wanted a board seat.

(00:23:02):

TWiTtter did not want him on the board. He got thrown off within 24 hours. And I think that that was what happened. I don't think he stepped out. I think he was thrown off at that point. He got pissed off. Is that when he made this bad deal, in any event, ever since within 24 hours, he was written to his lawyers saying, Hey, world War three's gonna break out. Can we back down now? You know, he said, I wanna hear what Putin has to say before we continue the purchase. Like Putin was gonna create World War three and maybe we better not own TWiTtter. He was trying to squirm he was right. He was squirming. He wanted to get out of it for a long time. Uh, at which point Brett Taylor, chairman of the TWiTtter board says, no, we're going to court. We're gonna hold his his feet to the fire.

(00:23:45):

He has an agreement. We're gonna make him agree. Elon said, no, no, there's bots. He came up with all sorts of things. I think we were getting very close the day before his deposition. Uh, we'd already seen this tranche of, uh, personal dms that were not embarrassing to Elon by the way, but embarrassing that every single other person was <laugh>, was DMing him, including Larry Ellison who says, I'll give you a billion. He says, can you gimme two? He says, yeah, two, whatever. Uh, he, he raised the money, he went through all the steps that takes some, you know, clout that takes some ability. He negotiated with the Saudi Sovereign Fund, he negotiated with Larry Ellison. He got Goldman Sachs and a bunch of banks to give 'em a 13 billion loan. Or is it 11 billion? Some huge amount. And then, but he wants to get out of it.

(00:24:31):

He, I think on the day before he's supposed to give his deposition, somebody told him maybe Spirow, his uh, personal counsel said, you're gonna go, you're gonna have to buy this. It's gonna go against you. The court is pretty clear. The Delaware Court a chancery, he is gonna make you buy this for 44 billion. Cuz at that point he says, all right, I don't want to go to court. I don't want this deposition. I don't want any more dms revealed. I'll buy it. All of that. Is that inaccurate, Phil? That that's, that that timeline. That seems like that's pretty much what happened. Yeah,

Phil Libin (00:25:01):

Well first of all, I own, uh, court of chancery.com. The URL

Leo Laporte (00:25:06):

You do wants it.

Phil Libin (00:25:08):

Yeah.

Leo Laporte (00:25:08):

So that's a good, that's a good domain. Why'd you buy that?

Phil Libin (00:25:11):

It's for sale. I think on the day, I think when, when Brett tweeted, uh, I'll see you at the Deliver chance.

Leo Laporte (00:25:16):

I was like, <laugh> smooth move.

Phil Libin (00:25:19):

So yeah. Best, best offer accepted. That's good.

Leo Laporte (00:25:21):

Like, that's as good as three feet. Yeah.

Phil Libin (00:25:24):

But I, um, look, sure, uh, I mean some version of that probably happened, but you can al but like, I think there's a different OMS razor way to look at this, right? The simplest explanation.

Leo Laporte (00:25:37):

What's the simplest explanation?

Phil Libin (00:25:39):

Like Elon's kind of being obnoxious on TWiTtter, because that's what one does on TWiTtter, and that's what, that's what people are rewarded for on TWiTtter. And that's like the point of TWiTtter. And he kind of has that, you know, as part of his personality, uh, traits. Um, he, I'm sure, I'm sure you guys are right, he probably underestimated some of the complexity. Probably came in there thinking like, I build rockets that can, you know, land on earth. Like a how could it be? And I'm sure he, he underestimated it and he pissed a bunch of people off and a bunch of people quit and a bunch more people quit. That all makes sense. But at the end of the day, he really did build these rockets that land back on earth. And he really did build the car that I drive right now, which is the best car that I've ever owned. And it TWiTtter, like, yeah, it's, it's, it's more complicated than he thought, but it's less complicated than the stuff that he's, that he's done before. And I think there's a very strong chance that, again, with way more drama than I would've wanted to see. It's gonna turn out okay. And if he can actually do some of the things that he's talked about and, and of course there's gonna be outages, there'll be failures, there'll be outages. But we all remember the fail,

Leo Laporte (00:26:42):

The fail. Well, we can live, we

Phil Libin (00:26:44):

Can survive. So like, yeah, yeah. It'll be, there'll be outages. And I think, again, I'm not guaranteeing this, I don't know, and you know, I'm not, I don't predict the future. I think there's a very strong chance that like in a, you know, within a few months, like it's gonna be better than it was a few months ago and it'll be fine. Um, and that's kind of what I'm counting for because like I would try Macon, but I can't deal with another Elephant app right now. So <laugh>

Glen Fleishman (00:27:06):

Need TWiTtter.

Phil Libin (00:27:07):

Need to

Glen Fleishman (00:27:08):

Make it,

Leo Laporte (00:27:09):

You know, I love, by the way, I love this, you're talking about Mastodon. I love the fact that some people have left TWiTtter for the fed averse Mastodons, just one instance, but the Fed averse, and those people are a certain kind of geeky, tend to be liberals, tend to be left wing. Uh, and they're finding a home. And that's fine. And I would love to see TWiTtter. I think you're right Phil. I think he will find a way to make this work. He spent way too much money and so he'll find a way to make this work. And there are, there have to be good engineers out there. He could bring in, there may be a learning curve for them as well as him. TWiTtter's so important. My problem is that the hardest thing about TWiTtter is something, by the way, that they never really solved. Forget monetization. Cuz advertisers are already going. I don't want anything to do with this. CBS came back though, which is weird. Not

Phil Libin (00:28:01):

As an advertis. They said they were gone, they were gone for much of the weekend. Yeah.

Leo Laporte (00:28:04):

Which is, it's weirdest. Like that's like much

Phil Libin (00:28:06):

Of the

Leo Laporte (00:28:07):

Weekend. That was a strange thing. Uh,

Phil Libin (00:28:09):

I took a nap for much of the weekend.

Leo Laporte (00:28:11):

I know, I know. It was really weird. Oh, we, oh no, we're back. But advertisers, by the way, are not doing that. I have to say, advertisers are leaving the tech sector everywhere, right? So that's, I mean, we can't, we can't sell podcast advertising and save our life in 2023. So that's not just TWiTtter's problem, but that's also not my problem cuz Elon will figure out how to monetize or not. But he'll figure that out. I worry more about the moderation problem. Mm-hmm. <affirmative> and, uh, and, and what the problem, what is that old saw, you probably know this Glen, where you let one Nazi into your bar, and then pretty soon you own a Nazi bar.

Glen Fleishman (00:28:48):

Oh yes. There's somebody, yeah. There's a bartender who told a good story about that on TWiTtter about right. Was like the first one comes in and they, and they seem, they're there by themselves and they, you know, they don't make much of a fuss. And if you don't throw that guy out, then pretty soon you're a Nazi bar. It's like an inevitable, I mean, this is, this is all the, uh, the tolerant being overwhelmed by the intolerant, right? There's a whole political philosophy about how we should not, or an argument, I don't wanna say a pH uh, it hasn't been decided, right? This is a whole societal issue, is, is it better to let people talk and let sunshine in or to moderate suppress, do other things outside of governmental approaches, not government censorship to prevent points of view that crowd out other speech, right?

(00:29:30):

This is always the battle we have is, is free speech when people are free speech, so-called maximalist talk about it. They talk about everyone being able to speak freely and yet some speech crowds out other speech and there's no balance in that power. So I think that's the Nazi bar scenario is like, if you let too many Nazis on TWiTtter and it, you know, this is the thing. He's like, I think, uh, un suspending Kathy Griffin and Donald Trump and Jordan Peterson and a few other people all at once is actually sort of a master stroke. If he had just done people who were right wing figures or people at a certain cultural matrix, but he let Kathy Griffin back on and she's over Macedon saying, no, thank you. I'm not, I'm not even gonna pay attention to that. Uh, that's a whole different argument about what he's trying to chart.

Leo Laporte (00:30:13):

Yeah, I think Cathy Griffin is, was a throw in because everybody else, cat turd and the Bumblebee cat, turd, bumblebee and Donald Trump, the big three, uh, those are all on the right hand side of the, uh, aisle. I think that that is not Elon Elon's, I'm sure not a RighTWiTnger. He's probably a libertarian. Uh, and, uh, and probably once the free speech thing, he likes that idea. But as he's quickly learning, free speech doesn't sell Adss. And it, and it does, and it's a Nazi bar problem because,

Glen Fleishman (00:30:45):

And it, it doesn't comply to national law. Like they're gonna have cs a csam problems immediately like this is, uh, unless they have the staff in place, you

Leo Laporte (00:30:53):

Could still watch

Glen Fleishman (00:30:54):

Indicate the

Leo Laporte (00:30:55):

Movie speed. I'm told on TWiTtter, <laugh> tweet by tweet you only get a few minutes per tweet. But you could still do that. And they haven't taken that. So they're gonna have a big moderation problem now. May, I mean, maybe he's gonna bring in a thousand new moderators and it just takes a

Glen Fleishman (00:31:10):

While. One good AI

Leo Laporte (00:31:11):

Takes a while to do that. And at that point, let's say it takes him a year, which is a reasonable amount of time, uh, who's gonna be left and who's gonna wanna be part of it?

Phil Libin (00:31:19):

Look, I think, um, how much you, the problems of the speech problems on TWiTtter right now, um, would've existed, you know, a few weeks ago would've existed pre Elon. If the, the, the people who are making the problems were all incented to right now go and do do the stuff that they're doing. You're kind of having two things happen, right? The first thing that that happened is Elon took over and now every Nazi or anything else, like, this is the time. This is like, ah, like this is my moment now is when I'm gonna do this. Whereas before, you know, like their activity was spread out over the course of many years now. Like everyone in the same week is gonna be like, yeah, I'm gonna make fake corporate accounts and I'm gonna upload the movie speed and I'm gonna be a Nazi. Because like, that's where all the attention is because then CNN is breathlessly reporting, right? About how like TWiTtter is falling apart. Like if you were gonna do shit on TWiTtter, you would wanna do it last week because like now's

Leo Laporte (00:32:12):

The

Phil Libin (00:32:12):

Tie of Farron is on is on you. Yeah. So even if, even if El had changed nothing and it was like literally the same exact code base, which I think mostly still is, there's obviously some changes. Um, you still probably would've had the same, you know, the same problems. So the, your question really kind of decouples into two parts. You said, what if it takes him a year? It decouples into two parts. How long does it take for it to get incrementally better than it used to be? And I think, you know, every couple of weeks it can get incrementally better. And at the same time, how long does the, does like the moment for the Nazis stick around because they're gonna lose their interests. They're not gonna like, keep up this intensity of douche bagger for the next year.

Leo Laporte (00:32:50):

Well, like

Phil Libin (00:32:51):

It's gonna slow down.

Leo Laporte (00:32:52):

I might argue with that because we have, uh, fans who have never given up after five years of trolling us. Uh, the people, of course the people who are into this are very persistent and do not give up cuz they're nuts <laugh>.

Phil Libin (00:33:08):

But, but the people, but the people like the people like posting, you know, movies and like doing that kind of stuff.

Leo Laporte (00:33:13):

There's a lot of like, those people go away of course, but

Phil Libin (00:33:16):

That's most of them.

Leo Laporte (00:33:16):

That's trolls. Um, I don't know if that's most of 'em. I mean, who's on, who's on Truth social? I don't know if that's most of them. There is, uh, there is a, a large contingent of Americans about half who, um, are filled with hate.

Dwight Silverman (00:33:32):

You know me about that, Phil, you think half,

Leo Laporte (00:33:34):

Half. Yeah. I think hate. Yeah, I think half

Dwight Silverman (00:33:37):

Phil, you know, you, you, uh, talk about, well he has put rockets in space and, and revolutionized the electric car company, but rockets and cars are not media and, um, media's a lot harder than it looks. And TWiTtter is media and Leo's right about the moderation problem. Those trolls do not go away.

Leo Laporte (00:34:01):

Look at four chan, look at eight chan or

Dwight Silverman (00:34:03):

18. Yeah. Right, right, right. And, and, and so, you know, I think, um, Elon has two personality failings that, um, that he's always had. And they, they come into, uh, they come into this situation and kind of have bloomed one of them as hubris. And the other is he really believes he huffs his own, uh, smoke. And he really believes that he knows better than anybody around him. And so he tears it up and then is kind of surprised at the mess he's made and calls them back. Um, he, he essentially kind of doesn't know what he's doing, uh, and is now winging it. And he may indeed be able to bring it back. You know, supposedly he's got this plan to create, uh, a kind of Uber app, uh, x.com mm-hmm. <affirmative>, uh, that, so essentially you could, you know what he may be thinking as well before you can create something, you have to destroy it.

(00:35:03):

And that's kind of what he's doing. But it didn't have to be that way. And he's, he's ruined lives and he has, uh, you know, crippled careers. A lot of these people are going out into a market where they're, where tech companies are laying off not hiring. Yeah. And so it's, uh, you know, he didn't have to be done this way. I saw a headline that referred to his brutal management style. And I think that that's, that's the problem. The, you know, the question becomes if you're a TWiTtter user, if you're a TWiTtter investor Yeah. If you are a regulator, does the end justify the means? And um, you know, to me it sure

Phil Libin (00:35:41):

Doesn't. I agree that it didn't have to, it didn't have to do it like this. Uh, I think he would probably agree with you at this point that he didn't have to do it like this. Uh, yeah. Much more drama than, you know, than I would've wanted to see. Or, but a separate question from, you know, is it really time to like write the TWiTtter obituaries? I I I very much doubt that it's time to

Dwight Silverman (00:36:01):

Write the TWiTtter abi. I think you could. I think

Leo Laporte (00:36:02):

It felt like the, on Friday night, I gotta say everybody was, was saying

Dwight Silverman (00:36:06):

Goodbye Irish and survived. It was wildly survived. It was wildly entertaining. And, uh, and both bittersweet at the same time. I can't remember an evening on TWiTtter that I think was that affecting.

Glen Fleishman (00:36:21):

And you saw Ryan Brodrick and, uh, Katies from, uh, Buzzfeed, uh, they got, they started a TWiTtter, what is it called? Social Spaces. I forgot.

Leo Laporte (00:36:29):

That was a weird event with

Glen Fleishman (00:36:31):

Like 20,000 people. So in the middle of, it was fascinating to say TWiTtter's dying, but here's 20,000 people wanna join a TWiTtter thing. And it mostly ran. Okay. And was it tuned it for, I don't know, 20 or 30 minutes? And it was wild. It was actually an example of the best of what TWiTtter has to offer. And

Leo Laporte (00:36:49):

Elon pointed out they had the biggest weekend of all time. Yeah.

Glen Fleishman (00:36:52):

I'm not TWiTtter surprised everybody. I But that's Rubberneck.

Dwight Silverman (00:36:55):

That's right. That's rubbernecking. That's watching a car crash.

Glen Fleishman (00:36:58):

Yeah. I mean, are people feeling like they're going to, it's like why do you go to the speed way people often go to the speedway to watch cars

Leo Laporte (00:37:04):

Crash? Yeah. I'm really glad we had John Phil cuz I knew that you would be the sense of, uh, voice of reason in all of this <laugh> and with your experience and expertise. I wanted to hear what you think. And you're not an Elon Musk stand. Uh, but, but I think you, you're quite reasonable in this. And I, and I hope you're right because I I, I'd hate to see TWiTtter just turn into four chan. I think that that would be a very sad end to something that was so vital for so many people. One of the things you were seeing on, on Saturday and Friday was people saying, I met my spouse here. Um, you know, some of the best interactions I ever had in my life on TWiTtter. And I, you know, some of the most hateful interactions I've ever had in my life were on TWiTtter as well. But, uh, TWiTtter is important and it'd be a shame to lose it. I feel more that way about TWiTtter than I do about Facebook, for instance, which I don't think will be a huge loss. You know,

Glen Fleishman (00:37:52):

I wouldn't be sitting here talking to the three of you if it wasn't for TWiTtter. Exactly. That's how we got to know you. Exactly. We're all para friends. Yes. Yeah. Most of the best things have happened. My professional life in many of my personal life have happened, uh, in the last decade on TWiTtter. I've been able to change my career from being a, uh, technology journalist into a 19th century printing expert in part <laugh> because of TWiTtter. So thank you.

Dwight Silverman (00:38:13):

Yay.

Leo Laporte (00:38:14):

I'm sure that's a career direction I would recommend for forever.

Glen Fleishman (00:38:16):

No, there's lots of, let me tell you, there's lots of money in 19th century printing research,

Leo Laporte (00:38:21):

<laugh>. But Phil, I, you know, I think your points are really well taken and, uh, and you're the voice of reason. So thank you. It is true that it's no surprise that there's a lot of outrage and, and storm and drawing associated with TWiTtter. That's what it was,

Glen Fleishman (00:38:37):

You know, designed. Phil, I wanna hire you as my therapist because you're totally, so much you. So, I mean, I'll say I've run businesses in which I've had at least one employee, so I feel very qualified to talk about an enterprise with 7,500. So I feel we're, you know, you're in a better position, but it's also, I think it's good. It's, it's very easy. I think what we're talking about is an excellent example of that phenomenon you're describing, which is TWiTtter is about drama. It's optimized for drama cuz it optimized for engagement, which improves advertising sell through. It's not too, uh, horrible, right? Advertisers don't wanna sell against horror, but they wanna sell against a certain level of churn. And so I feel drawn into that cause I'm watching every day this nonsense people be away, the chaos. And I'm like, oh, but I can listen to Phil and I can step back and say, you know, this is gonna settle out or it's not. And I don't have to, I don't have to get all fussed about it. So actually I appreciate that. Right.

Leo Laporte (00:39:28):

Thank you. We're gonna take a little break and come talk about something of much more consequence Crypto in just <laugh>. No, I'm just kidding. We'll find something. We, we'll cheer you up in just a bit. Uh, great to have Phil Libin here. Actually, I want to talk a little bit about, uh, about the history of, uh, Evernote CEO and founder of All turtles.com. But his, in his previous life, he was the guy who put Evernote, uh, on the map. And, uh, and Evernote is in the news again this week. We'll talk about that in a little bit. Glen Fleishman, that he's in charge of fun@glen.fun and, uh, at fun and Flus is his motto.

Glen Fleishman (00:40:03):

Fun and flungs. There

Leo Laporte (00:40:04):

We go. Yep. And, uh, always, always a pleasure having you. And of course, uh, thank you. My great Dwight Silverman, all three a u t h o r y.com/d Silverman. Both Glen and Dwight use authoring to collate all of their many multifarious, uh, work, which is really cool. Um, I didn't realize you also use it and it, and it, it actually solves a problem that people like you modern, you know, journalists have, which is you everywhere

Glen Fleishman (00:40:33):

Abouts.

Leo Laporte (00:40:33):

It's it's abouts

Glen Fleishman (00:40:36):

Abouts. A piece of irony is that I wrote my first article about link rot in 1997, and of course it was dead by 1999. <laugh> could not get to the article. It was like, that's irony.

Leo Laporte (00:40:46):

The solution to link ro author.com. Uh, our show today brought to you by Zip Recruiter, we have been so happy with Zip Recruiter, some of our best, uh, staff hired on ZipRecruiter, cuz this is, this is what happens. Uh, and, and, and Lisa is the one who ends up, you know, suffering. Somebody says, I'm gonna give you my two weeks. I got another job, or I'm moving, or whatever. And now we gotta fill that position. And of course, the problem is the person who's filling the position, at least in a small company like ours, is also the one who's gonna have to do the work of the person who's leaving while they're filling. And we all marry many hats in, in a business like ours. And it's hard to find people fast who are great. Well, it was until we found ZipRecruiter. Now, when we need somebody, we go to ZipRecruiter.

(00:41:32):

It's been our experience. Within an hour or two we'll get great candidates. And let me tell you why this works so well. It doesn't matter whether you're hiring a civil engineer in New York, a pediatric nurse in Nebraska, attorney in Colorado, or even a mascot in Missouri. If you've seen the ads or a continuity manager in Petaluma. Zip, ZipRecruiter helps you find quality candidates fast. And the way it works is so great. You post, uh, your opening on ZipRecruiter. Now they're gonna post it immediately to more than a hundred other job sites and social networks. So you're immediately casting a wide net. But that's when ZipRecruiter's technology kicks in because they will find people with the right experience and then tell you about them so you can invite them to apply. So this is really cool cause it turns out when you have a job opening and you're inviting somebody, you're saying, Hey, I saw your resume and I think you'd be great for this job.

(00:42:24):

Actually, super recruiter did it, but we don't tell 'em that and we think you'd be great for that job. That person is so excited to hear from you. They show up, they do the interview. I don't know if you had this experience, but ghosting interviews is a very common thing nowadays. You don't get that when you use ZipRecruiter plus all of those people applying for your job. They don't come to your phone or your email. They go into the ZipRecruiter interface. You can screen them with yes no questions, multiple choice, even essay questions. They reformat the resume. So it's easy to read them. They do all this stuff to make it easy to hire Fast and fast is important when you've wearing many hats, right? Four out of five employers who post on ZipRecruiter get a quality candidate within the first day. But I could tell you our experience has always been within a few hours, which is such a relief because now we know we're gonna find somebody.

(00:43:12):

I love Lisa. She'll post it breakfast and by lunchtime she's going, oh, this person's great. Oh, we got another one. It's such a relief. Try it free today, ziprecruiter.com/TWiT. It is the smart way to hire zip recruiter.com/t i t. We thank ZipRecruiter for the job they do for us. We thank 'em for advertising on the show, and we thank you as, uh, listeners for using that address so they know you saw it here. That really helps us too. ziprecruiter.com/TWiT, the smartest way to hire. Thank you ZipRecruiter. Uh, good conversation. The first kind of sensible conversation we've had about what's going on over, uh, at TWiTtter. So thank you all, uh, three of you for, for your analysis. Uh, okay. We need a breather. <laugh>. Let me, let me, let me find something. Uh, not so, uh, depressing and serious.

Glen Fleishman (00:44:13):

I was gonna say, oh, what about Fed Brooks has died? Oh. Oh no, that's not the,

Leo Laporte (00:44:17):

Let's not do that. Greg Barrett died. Oh no. How about Elizabeth Holmes going to jail for Woo 11 and a quarter years?

Glen Fleishman (00:44:26):

Yeah, I had funny feelings about it. Me, me too. I I've had a, I've had to, um, I feel like I've had a look inside myself because my reaction has been very shod and frey about her, where I think that's unfortunate. Like, I think she did, you know, listen, the court, uh, a jury decided she defrauded people. I think there's a lot of legal things you could say, but what she did, but I found myself having a little glee about like, oh, good, they got her. And then I'm thinking, ah, this poor woman, at some level, it was it, she, she did cause actual or seemingly cause actual harm to people who got misleading, uh, blood results. Like she could have put people in danger and there are issues there. But I also think she got, um, she got disappointed attention because of her gender.

(00:45:06):

And I think it was, there was a sort of gendered response to it. Um, she did lead a giant fraud and she should take responsibility for what she did and doesn't seem to be able to, but I also, I don't feel like I should feel great about anybody going to jail, especially when, you know, it's clear she has lots of the fact that she can't really see that she did anything wrong. That these these things, she, uh, ha is a futurist who was too optimistic. I think that is a sad thing. Not necessarily to be celebrated.

Leo Laporte (00:45:36):

Dwight, what do you think?

Dwight Silverman (00:45:39):

Well, you know, she, I I agree with half of what Glen said. She <laugh>, she, she, she committed fraud. You know, she defrauded investors, she misled people. She, you know, to a certain extent she provided hope when there was no hope really. And, um, you know, the, the sentencing guidelines were what, 11 years to 20 years mm-hmm. <affirmative>. And I was looking at that and I was thinking, you know, her, her, um, conduct was so egregious that I was thinking the judge could go 15 to 20. And so I was a little surprised that she only, and I say only she

Leo Laporte (00:46:16):

Got the minimum, I

Dwight Silverman (00:46:17):

Think she got the minimum. Yeah. And

Leo Laporte (00:46:20):

We should say the judge has discretion and can go lower than the guidelines. Right? Right. She's not required to go guidelines, but she did in this case. Yeah. Yeah.

Dwight Silverman (00:46:31):

I just,

Leo Laporte (00:46:31):

I look at somebody like Alan Weis Weisselberg who was the CFO of the Trump organization who got what, six months?

Glen Fleishman (00:46:37):

Well, he, he might get a hundred days I think if he, if he fully cooperates.

Leo Laporte (00:46:41):

So I just feel like for

Glen Fleishman (00:46:43):

Stealing, I mean for yeah,

Leo Laporte (00:46:44):

The involvement. Here's, to me the rule is don't defraud George Schultz because if you defraud the, the biggest, most important, most powerful people in the country, we're gonna get

Glen Fleishman (00:46:55):

You. Okay. Wait. You want something fun to talk about? Is George Schultz has a tiger tattoo on part of his

Leo Laporte (00:47:00):

Body. Cause he's a Princeton man as all big. There's do you don't wait a minute, tell me you don't have a bulldog on your butt.

Glen Fleishman (00:47:06):

I I have no bulldogs on my be well

Leo Laporte (00:47:08):

How, what kind of Yale man are you? <laugh>? Um, Phil, what do you think? 11 years out outrageous or appropriate?

Phil Libin (00:47:17):

Um, uh, I have really complicated feelings about it. I think it's, it feels unfair to me. Um, uh, it feels unfair. Not, um, not compared to other people that have been sentenced for fraud. Uh, you know, Madoff got 150 years and, uh, you know, Jeffrey Skilling got 14 years or whatever. So that, that seems in line, but it feels unfair when you compare to all the people that we know have done far worse that never get prosecuted. So I think it depends on the frame of reference. If you're, if you're, if you're comparing her to other people that have been sentenced for this kind of stuff, then yeah, it's about right. But it's hard for me not to compare it to all the people that I know do far worse every day and that don't get prosecuted and don't get anything. And I think in general, like, I don't like these, um, you know, send a message sentences.

(00:48:07):

Um, I think they're unfair. I think like what we should do is we should prosecute many more people. We should give, we should be like much more consistent with prosecuting fraud. We should have much more prosecution on, you know, white collar crime. Um, so that it should be a predictable outcome of defrauding people as it is right now. We prosecute very few people and then the ones that we convict, sometimes you get massive sentences, but I don't, I don't, a that doesn't seem fair to the person getting a sentence and b, that doesn't seem like the right kind of deterrent effect because like, I don't think most would be fraudsters are deterred by, oh yeah, this is the one in a million shot that, you know, maybe I'll get caught and go to jail.

Leo Laporte (00:48:43):

You the next Elizabeth Holmes isn't looking at this going, oh, well I better not defraud anybody. Right?

Phil Libin (00:48:47):

No, but if, but if, but if, like, if, if you were gonna do this and you'd be like, well, there's a 25% chance that I'm gonna wind up being convicted and going to jail for, you know, a year, like, I think that would be a much, much less of a turn. So it feels wrong to me and it feels wrong because I know lots of people who do far worse and they don't get prosecuted at all.

Leo Laporte (00:49:04):

I hope you turn them in. Phil <laugh> by the Phil's plane is landed in now, apparently he's in, uh, Tokyo for the Cherry Blossom

Phil Libin (00:49:14):

Festival.

Leo Laporte (00:49:15):

That's, uh, that's great. Tokyo, last year in February. So, uh, <laugh>, uh, and I, you know, I, we all have mixed feelings. Part of my mixed feelings are inappropriate, which is that she has a one year old and she's pregnant with another child that's two children who will not have their mom. Now will she do 11 years or is there a good time Good, good time off.

Phil Libin (00:49:35):

It's a federal sentence. If she, unless her appeal comes in, she's in, there's no, there's no law in

Leo Laporte (00:49:40):

Federal. Even if she goes to the country club jail, that's hard time.

Phil Libin (00:49:45):

A federal prison, there's,

Glen Fleishman (00:49:48):

Oh, sorry. There's a law and order episode that, uh, that a number of years ago that I always think about in terms of this when I try to calibrate my feelings, it's an episode that it plays on that of someone's kidneys are stolen and they wake up in a tub of ice. Uh, urban myth, which circulates this literally happens in the episode. If somebody wakes up, his kidneys been stolen, <laugh>, it's, and they eventually figure out that it's a guy, it's a very rich man whose daughter needed a kidney and he couldn't get one through al way. So he essentially hired someone to, um, hired goons to find somebody with a good kidney that was a match and then hired paid doctors huge amounts of money to perform the surgery. And the great line at the end, on the stand stand was, you know, Mr. Soandso, uh, this time was a kidney.

(00:50:30):

He survived. He's actually gonna be fine. The person who's organ you rip from his body. But if it had been a heart, would you have done anything differently? And I sometimes think that's the calibration factor, is I think about homes and I'm thinking it does seem like too much. It doesn't seem like it has a deterrent effect. I feel bad for her children, her family, and the harm she committed. Did she, you know, was she out there actively killing people? Uh, you know, well there's some arguments that there was. So there were, uh, adverse health effects that resulted from some people getting a bad test, infor test information. And the thing is, I think if a hundred people had died from this, as opposed to

Leo Laporte (00:51:05):

That would be different. I, if there's

Glen Fleishman (00:51:06):

That would be d Yeah. And I, but I think also, I don't think her behavior would've necessarily been any different is

Leo Laporte (00:51:11):

The problem. Well, and if I'm sunny ball, not divorce, she's remorseless she was. Well cuz she didn't

Glen Fleishman (00:51:16):

Think she, she feels like she doesn't think she,

Leo Laporte (00:51:18):

This is what you do in tech. Somewhat. I have to say somewhat our own culture is to blame because we lionized her and she was taught to some degree that, that you fake it till you make it. Right. Yeah,

Phil Libin (00:51:33):

Absolutely.

Leo Laporte (00:51:35):

And that, that's how Steve Jobs made it. That's how Elon Musk made it. You, you, you just, you go and you go and you go until you, you make it. And sometimes you don't.

Phil Libin (00:51:45):

I I think, I think there's two issues here that are, that are, that are separate. And so whenever I find myself having these like, conflicted feelings, I try to like figure out like, well others, is there more than one thing that I'm having feelings about? And I think in this case, there are, I think like the real issue here is that this verdict highlights how few people get prosecuted. Fraud. Like that's the real, like that is more important to me than how much Elizabeth home should serve.

Leo Laporte (00:52:08):

Cause it's hard to, I guess, cuz it's hard to prove, it is

Glen Fleishman (00:52:11):

Hard to prove a lot of, a lot of money went into this trial, that's for

Phil Libin (00:52:14):

Sure too. Yeah, yeah. For, for all sorts of reasons. Um, but, but, but, but, but very relatively few people get prosecuted for it. And, and, and this like, points that out. And that's like, that's, that's, that's a big problem. That's separate from, you know, does she deserve 11 years or five years or whatever. And I'm like, I'm less attached to that position. I think personally, it doesn't really do anyone any good to lock her away for 11 years. Uh, so I would've done something a lot more lenient, but, but I'm also totally happy to be like, Hey, I'm not the judge. You know, this is the way the system works. Whatever. Let me reason that I feel it's

Leo Laporte (00:52:48):

Go ahead. I'm sorry. Finish

Phil Libin (00:52:49):

Your sentence. I said no, the reason that that, that it feels unfair to me is because it points out how we look at all these other people. But that's justice aren't prosecuted

Leo Laporte (00:52:57):

At all. Justice has always been uneven. Right. It's impossible. It's, it's a, it's the nature of justice. You do the best you can. You can't fault, uh, a sentence because not everybody gets the same sentence. It's unfair. Some people get six months, some people get 11 years, some people don't even get caught. We do the best we can. It's a very imperfect system.

Phil Libin (00:53:19):

Yeah. You can say that. There should be, you know, more, more prosecutions for things that are likely fraud.

Glen Fleishman (00:53:25):

It's, I I think we could pull up, uh, Trevor Milton from last month or six weeks ago, the founder of Nicola who, uh, was convicted of, I just wanna, it's clear he's clear one kind of securities fraud and two counts of wire fraud. Um, but, you know, that was, that is an amazing case. And, and that I have no concerns about what time he gets put away for, because the man is clearly, uh, completely pathological.

Leo Laporte (00:53:46):

He's facing 20 up to 25 years, but sentencing

Glen Fleishman (00:53:49):

Is in danger. Yeah. He's got a multi-decade career of telling people all kinds of things. And, uh, you know, it's

Leo Laporte (00:53:54):

A very, it's similar fraud. Except it wasn't health fraud. It wasn't, nobody's life was endangered by Nicola.

Glen Fleishman (00:53:59):

Yeah. I mean Right. If some of the cars could have been dangerous if it actually worked. But, but I feel like it's, uh, it was a more straightforward thing where I, it was clear to like, I'm not always clear whether Elizabeth Holmes truly knew whether her stuff worked or not, or she was being, you know, pushing the window. Sometimes. Clearly not. And the courts found, or the jury found that she clearly went too far. But it was very clear that Milton knew he was pushing, or should have known, like morally, ethically, intellectually, that what he was saying was absolutely false. It was intentional. It was just such a, it was a scam as opposed to what I'm sure, I mean, I know that Elizabeth Holmes absolutely wanted to make that business a real thing.

Leo Laporte (00:54:36):

Meanwhile, uh, Billy McFarland, who did the fire festival got six years and, uh, and is in a halfway house now after four. Um, all the, although Ray Hush puppy got 11 years. So there you go. Ray

Glen Fleishman (00:54:48):

Hush puppy.

Leo Laporte (00:54:49):

<laugh> what? <laugh> the same week puppy Nigerian, um, man named Raymond ua aba AKA Ray Hush puppy, 11 years in federal prison. He was, uh, he was a kind of a, that guy, that guy. They got him, I did in Dubai. And, uh, and extradited him. He had been involved in mon vast money laundering, uh, uh, email compromise, bank heist, all sorts of stuff. And he got 11 years. I don't know, I think Ray Hush puppy, probably a worse guy than, uh, Elizabeth Holmes. What, what is the point of prison? Is prison to deter is prison to rehabilitate? Do you think Elizabeth home will be, homes will be a better person 11 years from now?

Glen Fleishman (00:55:37):

This gets in that whole, I mean, I, you know, I feel like the Carceral state is a huge problem and it feeds on itself, and we put people in jail to put people in jail and it feeds the industrial prison complex. I think there's a whole bunch. But then there's, you know, there's people we need to be protected against as a society, and there's people who need to be protected from themselves. And I think the overlap of that is we throw many more people into jail for reasons that don't make any sense and are non-productive for them and for society. Yeah. So like, I'm not worried that homes gonna come to my house and steal my blood, you know? So does she actually have to be in jail or are there other punishments that would serve a deterrent effect, um, for her. But there are people who I am worried would break into my house and steal my

Leo Laporte (00:56:17):

Blood and I Right. They probably, there's some crooks. I don't think Elizabeth Holmes is a, is an ongoing danger to anybody.

Glen Fleishman (00:56:23):

Yeah. I think that's the issue. Although, you know, then you have, well, I think Phil, I don't, I wouldn't wanna put this word into your mouth, but it's like Adam Newman is an example of somebody who raised

Leo Laporte (00:56:31):

Sailing.

Glen Fleishman (00:56:33):

Right. And then he's, he's completely successful in, but I mean, I think he's a true believer, uh, in what he does Absolutely. Religiously. So, but how was he never, I mean, I don't wanna make accusations against, so I've read books, I've seen things. It's like, I don't know that he ever did anything that he's even technically illegal, I don't know, has been charged anything. Right.

Leo Laporte (00:56:52):

The founder of WeWork who, who cost a son and that's a, that's a, a Yoshi son, billions of dollars,

Glen Fleishman (00:57:01):

A victimless crime,

Leo Laporte (00:57:03):

<laugh> and, and, and really put the soft Bank fund, uh, in kind of jeopardy after kind of said, oh, I believe in you, whatever it is you're selling, I want more of that. But

Glen Fleishman (00:57:15):

That's situation. What's the difference between, between Adam Newman and, uh,

Leo Laporte (00:57:18):

He's worth 1.2 billion and just got a huge, uh, gift from Andreson Horowitz to, to do his next big thing.

Glen Fleishman (00:57:26):

And again, I don't wanna accuse him of anything. Like I don't, I I think the fascinating part about him is, I think he did, he, he sold long and sold, or he, he talked long and sold short. So he couldn't fulfill exactly what he was promising. But I think he did it in a very carefully done way that had a potential. I mean, after I read one of the really well researched books about WeWork, I came out of it thinking this guy wasn't a scammer. What he was, was he had an arc where as long as he, this was Shades of ftx. And, uh, uh, Sam, what's his name? Uh, Bankman, uh, fried Frid, uh, is, uh, I think Newman actually had an arc where if you keep people believing long enough, there was the potential for profit to come at the other end of the pipe. Maybe not the way you

Leo Laporte (00:58:06):

See, I don't think so, actually. I think, uh, well,

Glen Fleishman (00:58:09):

I guess you're right there. What

Leo Laporte (00:58:10):

About Travis Kalanick? So have you ra you've raised money, uh, Phil, right? You've gone to VC

Phil Libin (00:58:15):

<laugh> a little bit. Yeah. Yeah.

Leo Laporte (00:58:17):

Um,

Phil Libin (00:58:18):

You, you're putting me in a tough spot. Cause I I know all these people.

Leo Laporte (00:58:21):

I know you do. So you can re at any point recuse yourself.

Phil Libin (00:58:25):

But I'm just curious. Son is currently a major investor in, in, in my company.

Leo Laporte (00:58:31):

I, I work for Sun when he bought Ziff Davis. Um, yeah. And I have great respect for the man. I think he was the victim, frankly, of Adam Newman. But, uh, that aside, is there something broken in the way we do vc that it rewards people like Elizabeth Holmes?

Phil Libin (00:58:48):

Oh, yeah. I mean, I think there's all sorts of interesting questions here. Uh, I mean, one, I think just very basic questions. Where did the money go? Um, where did the money go with Elizabeth Holmes? Uh, where did the money go with Adam Newman? Mm-hmm. <affirmative>, where did the money go with spf? And I think those are very different answers. Yeah. Yeah. And, and so good, I think that answer is kind of important to like determining the level of at least moral culpability mm-hmm. <affirmative> of people. And as far as we know, and I think we know pretty well, like Elizabeth Holmes didn't wind up with, with a big chunk of that money,

Glen Fleishman (00:59:18):

Right.

Phil Libin (00:59:20):

Uh, Adam Newman wound up with some of it significant amount, billion or so

Leo Laporte (00:59:23):

It's interesting that Mark Andreson would give him another 350 million.

Phil Libin (00:59:28):

Well, but, but, but, but seriously, like if you're evaluating, you know, fraud, potential fraud or actual fraud, like where, where did the money go? Right? Um, I think

Glen Fleishman (00:59:37):

Landlords, I think mostly right. I mean, we were salaries a lot of leases and that was,

Leo Laporte (00:59:41):

Had a high burn rate. WeWork

Glen Fleishman (00:59:42):

Was a real estate

Phil Libin (00:59:43):

Business.

Leo Laporte (00:59:44):

Yeah. And story where went, I understand, as I understand it was the real problem was always gonna be that he was making long term deals for leases and Shortterm deals with his customers.

Phil Libin (00:59:56):

Where did he go with Theranos?

Glen Fleishman (00:59:58):

Yeah, I always, well,

Leo Laporte (01:00:00):

That's a really good question.

Glen Fleishman (01:00:01):

This is the judge in the case. Remember they were trying to get 800 something million in damages. The prosecutors and the judge decided what was the number? It was 180 million. It was something substantially lower. Yeah. Uh, like 22 investors said they lost whatever. And I think it was because the actual scope of, they didn't spend as much money as it sounds because they had such a super high valuation that I, that the mark. Yeah, it was right. So as employee, so Holmes is the, the lawsuit was right. Was, or the money was spent for employees and equipment and real estate. And, but yeah, I don't feel like she, I'm sure she had some nice houses, but her family was very wealthy or somewhat wealthy to begin with. So

Phil Libin (01:00:35):

Yeah. As, as far as we know, like that money went to paying a lot of salaries for a lot of people and a lot of equipment. And like, it wasn't, if there was fraud and to some extent the court determined there was fraud. So that it's fine. There's fraud. There's fraud, but I think it's a very different type than what, what probably happened with ftx, for example, where, you know, money was just outright stolen.

Glen Fleishman (01:00:54):

Where is that money? The FTX money is

Phil Libin (01:00:57):

At

Glen Fleishman (01:00:57):

All, billions is gone

Phil Libin (01:00:59):

As far fraud goes

Leo Laporte (01:01:00):

There. Uh, spf it looks like now the latest is took 300 million off the table in their last round.

Glen Fleishman (01:01:08):

Yeah.

Leo Laporte (01:01:09):

So that's somewhere. Right? Unless he, I don't know. That's a lot of beanbag. I don't <laugh> I don't know what that's somewhere out

Phil Libin (01:01:19):

There. The incentives though. You, you asked a earlier question, uh, about like, what's what's broken about AC and, and, and I think like, look, I, I know, you know, obviously a lot of vs I, I, I was a VC myself for, for, for for two years at a general catalyst. A bunch of people are, are, you know, friends of mine. And I think for the most part, uh, a lot of these people are, are genuinely good people. They're, they're genuinely smart. They're genuinely good. They genuinely wanna do the right thing. Not everyone, you know who you are, but for the most part, <laugh>,

Leo Laporte (01:01:48):

They're, they're not though, uh, even thinking about or are they, you tell me, you know, um, do they think they're not trying to use their money to do good? They're trying to make an investment that will pay off.

Phil Libin (01:01:59):

A lot of them are trying to use their money to do good really interest a lot. Yeah, absolutely. But, but look, here's the thing, uh, here's is like the main thing that I've, that I've figured out, um, the vast majority of people, myself included, will act according to our incentives. Um, so first we act according to our incentives. If you look at how the incentives are set up, that will predict how we act. And then most of us, myself included, will act according to our incentives and then make up a narrative about why that action is morally sound.

Leo Laporte (01:02:25):

Yeah. That's how all decisions are made, by the way. Yeah.

Phil Libin (01:02:28):

That's

Leo Laporte (01:02:29):

How the line works. Oh my

Phil Libin (01:02:30):

God. And that narrative is, is is true. We believe it. We really do. Yeah.

(01:02:35):

But, but, but it's not surprising that it just so happens that the morally correct thing that we tell ourselves happens to always line up with our financial incentives the vast majority of the time. So if I wanna lead a moral life, which I do, the best way to do it, since I can't trust myself to not follow my incentives, is to make sure that I set up my incentives first to, to, to, to, to go in the direction that I want to go. And, and not everyone does that. So when you look at how VCs operate, how does, like how do they make money? What's the incentives? Well, they make money by investing. They don't make money by not investing. They make money by investing. They make money by investing a lot. They make more money by investing a lot. Yeah. They make more money by investing a lot quickly so they can raise the next ground so they, so they can raise to raise the next fund so they could, you know, stack management fees and carry and all that stuff. Uh, by the way,

Leo Laporte (01:03:23):

Fees, it's a business fundamentally,

Phil Libin (01:03:25):

Right? A hundred perc almost all of the incentives are set up for invest. Like, invest as much as you can. Now, the vast majority of these people will do it with due diligence or what they think is the right amount of due diligence. And they'll do it because they genuinely think that that, that it's money making. But the due diligence is always invest

Leo Laporte (01:03:43):

More. The question they're asking isn't, is not, is this gonna make the world a better place? Maybe that's a secondary question. The question is, this is gonna make money.

Phil Libin (01:03:50):

Is it real? Is it gonna make money? Yeah. And you can say, well, but you know, they should do 'em a lot more due diligence. Okay. But most of the funds, like, you know, even that invested in like FDX and stuff, like those funds are actually doing great. Right? Cause like the VC model is predicated upon, for the most part, believe founders. And yeah, once in a while, that's gonna screw you. But the belief founders like tends to, in the past of historically generated very good returns because you do get the Steve Jobs and the, and the everyone else's who like, yeah. Like to some extent there's a fake it until you make it, but enough of 'em make it and make it big. Um, that like, that it's worthwhile. So like this, this is the model, the way that it's been set up. And that's why when crypto comes along, it's like the greatest thing that a lot of these investors have ever seen because the crypto comes along and they're like, we need 420 million.

(01:04:45):

And you're like, for what? Well, it, I don't know, because no one knows what crypto's gonna cost <laugh>. Like there's no, like, it's not like a SaaS company where you can kind of say, oh, you need this many engineers. You're like, I don't know. And so the investors are sitting there looking at like, wow, I can raise an, I can write a giant check into this company, which means I can get my next, you know, fund. Like all of that. Like, again, all the incentives take over. So it's like, it is a, it is an incentive system sort of scamming itself, except actually over time, for the most part, it works pretty well. But then we pick bits and pieces to be like outraged over. Um,

Leo Laporte (01:05:19):